No clear, accurate report of the average customer acquisition cost (CAC) broken down by various services within the financial services sector is available online. Many financial services companies need this data to accurately estimate how much they should pay to acquire a customer. In this article, we break down the CAC by service for over 15 financial services.

We break down each financial service CAC into organic CAC, paid CAC, and an average of the two. This is the difference between organic and paid:

- Organic: Publishing consumable content to earn attention from potential customers. No money is paid for impressions.

- Paid: Ad platforms are paid in exchange for impressions on an advertisement.

Because we believe organic to be a superior marketing strategy, we have weighed the averages at 60% organic and 40% paid.

Calculating Customer Acquisition Cost

To calculate CAC, the following formula is used:

CAC = Sales/Marketing Expenses ÷ Number of New Customers Acquired

Average CAC for Financial Services

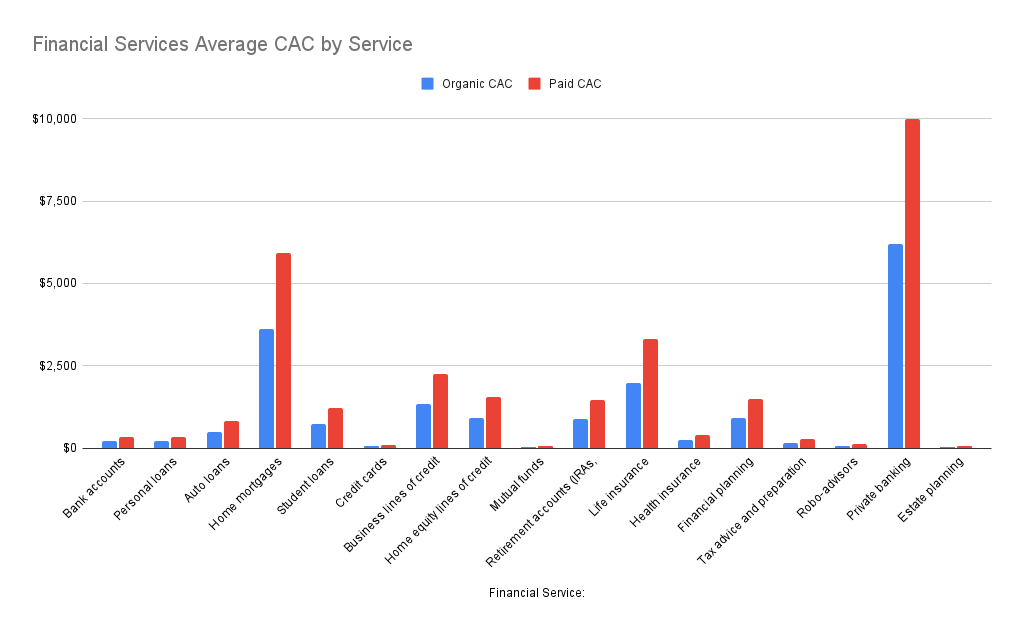

The table below lists over 15 financial services and their average organic, paid, and average CAC.

Financial Service Organic CAC Paid CAC Average

Bank accounts $211 $352 $267

Personal loans $210 $350 $266

Auto loans $496 $826 $628

Home mortgages $3,612 $5,911 $4,532

Student loans $741 $1,235 $938

Credit cards $54 $90 $68

Business lines of credit $1,357 $2,249 $1,714

Home equity lines of credit (HELOC) $924 $1,540 $1,170

Mutual funds $42 $67 $52

Retirement accounts (IRAs, 401(k)s) $887 $1,478 $1,123

Life insurance $1,980 $3,303 $2,509

Health insurance $245 $409 $310

Financial planning $904 $1,497 $1,141

Tax advice and preparation $163 $272 $206

Robo-advisors $77 $123 $95

Private banking $6,208 $9,987 $7,720

Estate planning $48 $72 $58

Determining Your Target CAC

While we have provided benchmarks for measuring your CAC, this should not be treated as gospel for your company. Each company runs at different margins and the target CAC must be adjusted accordingly. We recommend using this data to ascertain how realistic your target CAC number is. For optimal marketing results, an LTV (customer lifetime value) to CAC ratio of no less than 3:1 should be achieved. If it costs $1 to acquire a customer, you make $3 back from them throughout their customer journey.

If your CAC is too high, this may indicate waste in your marketing efforts, as some campaigns are not yielding results. An in-depth, granular analysis should be done to find the waste. If your CAC is very low, you may not be running enough experiments with the marketing efforts to find more winning campaigns.

Lowering Your CAC

The best way to lower your CAC is to shift towards a more organic-heavy marketing strategy. While organic does take longer to scale, it will generate customers in far higher quantities and at a much lower cost than paid campaigns over a long time horizon.

We are experts in leveraging SEO and the Google Algorithm to drive revenue to our clients. If you are interested in learning more about our work, feel free to contact us on the contact us page.