Last Updated: April 2024

The insurance industry has a wide variety of products and marketing channels. Still, the average customer acquisition cost (CAC) for each product and channel has never been published. In this article, we break down the results of our study of the average CAC in the insurance industry broken down in the following ways:

- Product

- Price point

- Marketing channel

- Brand awareness

- Regulatory environment

Each breakdown is subdivided into organic and inorganic. In case you are unfamiliar with the terms:

- Organic: Organic marketing encompasses all forms of advertising where advertising dollars are not traded linearly for impressions. These forms of advertising are low-cost but must be consistently performed over a longer time horizon to yield maximum results.

- Inorganic: Contrary to organic, inorganic marketing makes up all channels in which marketing dollars are directly traded for impressions or traffic. These advertising methods allow for faster returns, but returns over time are limited.

Calculating Customer Acquisition Cost (CAC)

To calculate your customer acquisition cost, use the following formula:

Customer Acquisition Cost (CAC) = Total Amount Spent on Marketing / Number of New Customer Acquired

To obtain the maximum benefit from our research, we recommend calculating your CAC from each of your marketing campaigns and from each of your products prior to proceeding. Then, you will know how your results compare to our meta-analysis. If you find yourself paying more to acquire customers than you should, we have included best practices for lowering CAC at the bottom of this article.

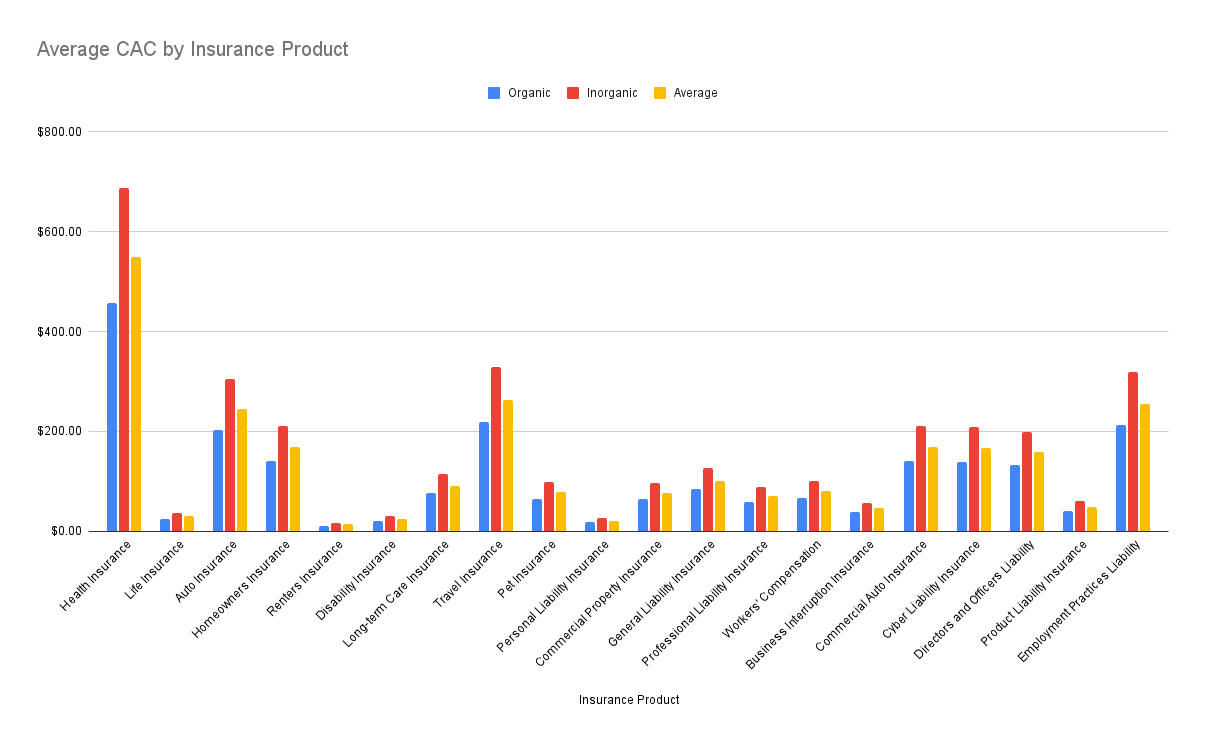

Average CAC by Insurance Product

This table shows the average CAC for each of the primary insurance products. As mentioned, the table is broken down into organic and inorganic.

Insurance Product Organic Inorganic Average

Health Insurance $457.92 $686.88 $549.50

Life Insurance $24.96 $37.44 $29.95

Auto Insurance $203.52 $305.28 $244.22

Homeowners Insurance $140.72 $211.08 $168.86

Renters Insurance $11.52 $17.28 $13.82

Disability Insurance $20.00 $30.00 $24.00

Long-term Care Insurance $75.84 $113.76 $91.01

Travel Insurance $218.88 $328.32 $262.66

Pet Insurance $65.28 $97.92 $78.34

Personal Liability Insurance $18.00 $27.00 $21.60

Commercial Property Insurance $64.32 $96.48 $77.18

General Liability Insurance $84.56 $126.84 $101.47

Professional Liability Insurance (Errors and Omissions) $58.56 $87.84 $70.27

Workers' Compensation Insurance $67.20 $100.80 $80.64

Business Interruption Insurance $38.40 $57.60 $46.08

Commercial Auto Insurance $141.12 $211.68 $169.34

Cyber Liability Insurance $139.20 $208.80 $167.04

Directors and Officers Liability Insurance $132.48 $198.72 $158.98

Product Liability Insurance $40.32 $60.48 $48.38

Employment Practices Liability Insurance $213.12 $319.68 $255.74

Note: All averages are weighted 75% organic and 25% inorganic as this is the ideal marketing mix for an insurance company.

Average CAC by Insurance Price Point

The price point of the premiums impacts the CAC, regardless of the specific product. This table displays the average CAC split out by the price point of the insurance.

Price Point Range Organic Inorganic Average

Low Budget $15 - $50 per month $31.20 $46.80 $37.44

Moderate Budget $51 - $100 per month $72.48 $108.72 $86.98

Average Budget $101 - $200 per month $144.48 $216.72 $173.38

Above Average $201 - $300 per month $240.48 $360.72 $288.58

Premium Coverage $301+ per month $384.48 $576.72 $461.38

Supply and Demand: While these figures are generally true, it is also possible that in areas of people purchasing one particular price point of policy, the CAC will be driven lower regardless. For example, in high-income areas where the number of people needing insurance for higher-value houses, cars, etc, the CAC for those high-priced plans may be pushed lower.

Average CAC by Marketing Channel

The table below gives a KPI to measure the results of marketing campaigns by channel.

Marketing Strategy CAC

Social Media $128.88

SEO $89.76

Email $50.64

Influencer Partnerships $310.68

Online Paid Ads $252.00

Direct Mail $369.36

Each paid marketing channel has a finite number of impressions available. In times such as the end of the quarter when companies are dumping excess budgets into online marketing platforms, you may experience a hike in CPMs (costs per 1,000 impressions) due to the excess bidding. In this case, the average CAC may rise.

However, CPMs may also rise due to ad fatigue. On ad platforms such as Meta Ads, you will be charged more for your ad to reach consumers if it is not properly resonating with them or if it has been shown too many times.

Average CAC by Brand Awareness

This table shows the average CAC by brand awareness, from large national brands to local insurance companies.

Brand Awareness Example Organic CAC Inorganic CAC Average

Global Brands Allianz $99.72 $149.57 $119.66

National Brands State Farm $105.26 $157.88 $126.31

Regional Brands Erie $116.34 $174.50 $139.60

Local Agencies Springfield Insurance $121.88 $182.81 $146.25

Large nationwide brands may have a lower CAC as more people will organically search for them or pay more attention when they see an advertisement from them. For smaller insurance companies, this can be avoided by running ads to dominate advertising and create brand awareness within a local geographic area.

Average CAC by Regulatory Environment

The following table displays the average CAC based on how heavy the regulatory environment is.

Regulatory Environment Explanation Organic CAC Inorganic CAC Average

Strict Rigorous rules and regulations governing the industry, including rigorous product approvals $138.50 $207.74 $166.19

Liberal More flexibility and fewer restrictions allowing for easier product approval $127.42 $191.12 $152.90

Evolving Market is currently undergoing significant changes which could move torward stricter or more relaxed regulations $116.34 $174.50 $139.60

Market-Specific Regulations are vast and distinct between insurance products and industries $110.80 $166.19 $132.96

The level of the regulatory environment will determine how much insurance companies pay to acquire a customer given that more regulation will mean insurance companies will operate at slimmer margins. Slimmer margins drive costs up, which means acquiring a customer will be more expensive.

Lowering Your CAC: Next Steps

There are many steps an insurance company can take to lower their CAC without the large marketing budgets and creative teams of multinational insurance companies. We have included three below:

Publish Lead Magnets Related to The Local Area

Lead magnets are pieces of information that a potential customer accesses by entering their name, email, phone number, address, or some combination of the former and other pieces of information. You may choose to give people “10 strategies to lower your auto insurance premiums in Winston Salem NC” or another piece of valuable content. Then, you can market to the list of people who obtain access to the lead magnet.

Implement a TikTok / Instagram Reels / YouTube Shorts Campaign

We’ve all seen people such as “Law by Mike” who consistently publish educational content in their industry. If the content goes viral, even locally, this can drive hundreds of new customers. We recommend doing this as a way to perhaps go viral, but also give prospective customers an impression of thought leadership, which may cause them to choose working with you over another insurance provider.

Implement a Localized SEO Strategy

Local SEO, performed artfully and thoughtfully, can be the highest ROI form of marketing available for insurance companies. By targeting keywords such as “homeowners insurance Greensboro NC” with highly satisfying content and information that is hyper-relevant to potential customers in the area. For example, for the mentioned keyword, one may choose to write thoroughly about the trend of premiums in Greensboro and the reasons behind the trend.

If you need help with local SEO or want a copy of this report, please contact us on the Contact Us page.

- Health Insurance Cost Per Month

- Average Life Insurance Rates

- Average Cost of Car Insurance

- Homeowners Insurance Cost

- How Much is Renters Insurance

- Long-term Care Insurance Cost

- Average Travel Insurance Cost

- Pet Insurance Cost

- Commercial Property Insurance Cost

- General Liability Insurance Cost

- Professional Liability Insurance Cost

- Workers’ Compensation Insurance Cost

- Commercial Auto Insurance Cost

- Cyber Liability Insurance Cost

- Directors and Officers Insurance Cost

- Product Liability Insurance Cost

- Employment Practices Liability Insurance Cost