Last Updated: August 2024

Most banks, especially local banks, are not tracking their average customer acquisition cost (CAC) as granularly as they should be. Breaking down CAC into individual categories such as loan type and service allows the bank to understand precisely where their advertising is yielding the highest ROI. Below, we have listed the average CAC for banks by:

August 2024 Update: Due to recent fluctuations in interest rates and uncertainty in the economy heading into the US Presidential Election, we see average CACs rising across the board for banks.

Calculating CAC & Defining Organic/Paid Channels

When calculating CAC, we use the following formula:

CAC = Total Spend on Sales/Marketing ÷ Customers Acquired

Additionally, you will see us segment CAC between organic and paid channels. The distinction between organic and paid channels is as follows:

- Organic (Earned Traffic): These channels include SEO, social media, email marketing, and other forms of marketing where it does not cost incrementally more money to gather more ad impressions.

- Paid (Bought Traffic): These channels include Google & Meta Ads, radio ads, TV ads, print ads, and other forms of marketing where to reach more people, more money must be spent in a generally linear fashion.

Average CAC by Loan Type

Our team has analyzed the CAC for each primary loan type and then split the data by organic and paid advertising channels.

| Loan Type | Organic | Paid |

|---|---|---|

| Mortgage Loans | $1,963 | $3,664 |

| Personal Loans | $196 | $366 |

| Auto Loans | $262 | $488 |

| Student Loans | $153 | $285 |

| Business Loans | $1,309 | $2,442 |

| Home Equity Loans | $654 | $1,221 |

Average CAC by Loan Size

CACs by loan size are heavily influenced by the demand for the loans of each size.

Loan Size Range Organic Paid

Micro $500 - $5,000 $26 $49

Small $5,001 - $25,000 $110 $204

Medium $25,0001 - $100,000 $308 $570

Large $100,0001 - $500,000 $881 $1,629

Very Large $500,001 - $1,000,000 $1,983 $3,666

Jumbo $1,000,001 - $5,000,000 $5,729 $10,591

Super Jumbo $5,000,001 + $8,814 $16,293

Average CAC by Account Type

Generally advertising for specific accounts requires a special incentive for marketing to be effective.

| Account Type | Organic | Paid |

|---|---|---|

| Checking Accounts (Individual) | $154 | $285 |

| Checking Accounts (Business) | $331 | $611 |

| Savings Accounts (Individual) | $88 | $163 |

| Savings Accounts (Business) | $198 | $367 |

| Certificates of Deposit (CDs) | $176 | $326 |

| Money Market Accounts | $154 | $285 |

| Retirement Accounts (IRA, 401k) | $441 | $815 |

Average CAC by Income Demographic

These ranges will vary based on the overall affluence of the location.

| Income Demographic | Annual Income | Organic | Paid |

|---|---|---|---|

| Low Income | < $25,000 | $66 | $122 |

| Lower-Middle Income | $25,000 - $49,999 | $132 | $244 |

| Middle Income | $50,000 - $74,999 | $264 | $489 |

| Upper-Middle Income | $75,000 - $99,999 | $441 | $815 |

| High Income | $100,000 - $149,999 | $705 | $1,303 |

| Very High Income | $150,000 - $199,999 | $1,322 | $2,444 |

| Affluent | $200,000 + | $3,085 | $5,703 |

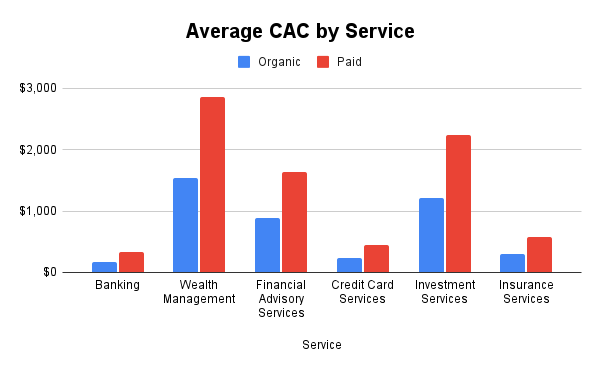

Average CAC by Service

Each service will have a different CAC based on supply and demand. We recommend segmenting advertising by service to ensure you are allocating budgets effectively to in-demand services.

| Service | Organic | Paid |

|---|---|---|

| Banking | $176 | $326 |

| Wealth Management | $1,542 | $2,851 |

| Financial Advisory Services | $881 | $1,629 |

| Credit Card Services | $242 | $448 |

| Investment Services | $1,212 | $2,240 |

| Insurance Services | $308 | $570 |

Average CAC by Location

Generally, acquiring customers in primary financial regions will be more expensive due to the larger average customer size.

| Location | Example | Organic | Paid |

|---|---|---|---|

| Financial Capitals | New York City, Tokyo | $1,542 | $2,851 |

| Primary Cities | Los Angeles, Chicago | $992 | $1,833 |

| Secondary Cities | Charlotte, Lyon | $661 | $1,222 |

| Tertiary Cities | Raleigh, Austin | $463 | $855 |

| Rural Areas | Scottsbluff, Sandpoint | $176 | $326 |

Average CAC by Channel

See the averaged CAC by channel for the most common advertising channels we have collected data for.

| Channel | CAC |

|---|---|

| Social Media | $398 |

| SEO | $318 |

| $239 | |

| Influencer Partnerships | $477 |

| Online Paid Ads | $557 |

| Direct Mail | $636 |

Tracking ROI Across Advertising Channels

For all banks, we recommend tracking various campaigns as granularly as possible. This can be done using various tracking software such as Google Analytics in addition to segmenting leads by service, so conversion rates can be tracked as well. This is beneficial because there is a high chance that if your marketing campaigns are unprofitable as a whole, it is just a few components of the marketing campaign moving the average CAC upwards, and there are some profitable campaigns running.

We also recommend tracking your CAC:LTV (customer lifetime value) ratio. Generally, you should spend up to $1 in advertising to acquire $5 in revenue over the lifetime of a customer. If the CAC to ratio is too high, say 1:10, it means your marketing is too efficient and you are leaving customers on the table. But, if your CAC:LTV ratio is 1:2 or 1:3, you should scale back the campaigns until you have a strategy to either lower CAC or raise LTV.

Focus Digital specializes in lowering CAC for banks and other businesses through thought leadership-based SEO campaigns and website conversion optimization. If you would like a strategy call to discuss where your biggest opportunities are, feel free to reach out to us on our Contact Us page.