Our team performed a meta-analysis of the average customer acquisition costs (CAC) for wealth management. While the average customer acquisition cost for wealth management overall is between $1,500 and $3,000 depending on the source, these metrics may or may not count for factors such as the wealth manager’s time to acquire a client based on the value of their time and the amount of time needed to acquire clients of different net worths.

For the purpose of this report, we will consider wealth management to begin at a net worth of $250,000, which according to some sources may be considered low. We have broken out the average customer acquisition cost for wealth management based on the following categories:

- Net worth of client

- Acquisition channel

- Size of wealth management firm

- Wealth management service

The purpose of this report is to determine, as granularly as possible, what your customer acquisition cost should be. To begin, here are a few definitions:

- Customer Acquisition Cost: Total spend on marketing + time spent in dollars ÷ number of new customers acquired

- Organic CAC: Encompasses marketing channels where money is spent on the production of systems that market the business (SEO, email marketing, word of mouth, posting on LinkedIn, etc.)

- Paid CAC: Encompasses marketing channels where money is spent on buying ad impressions directly (Google Ads, Direct Mail, etc.)

Upon first glance at this report, CAC metrics may seem high. Remember that our metrics include a calculation for the time of the wealth manager to acquire the client, not only what is spent on marketing.

Average Customer Acquisition Cost by Net Worth of Client

The following table breaks down the average CAC by the net worth of clients.

| Net Worth Ranges | Organic CAC | Paid CAC |

|---|---|---|

| $250,000 - $500,000 | $1,430 | $2,148 |

| $500,000 - $1 million | $3,065 | $4,602 |

| $1 million - $2 million | $6,130 | $9,204 |

| $2 million - $5 million | $14,304 | $21,477 |

| $5 million - $10 million | $30,652 | $46,021 |

| $10 million - $25 million | $61,303 | $92,042 |

| $25 million - $50 million | $143,040 | $214,765 |

| $50 million - $100 million | $306,515 | $460,212 |

| $100 million plus | $510,859 | $767,019 |

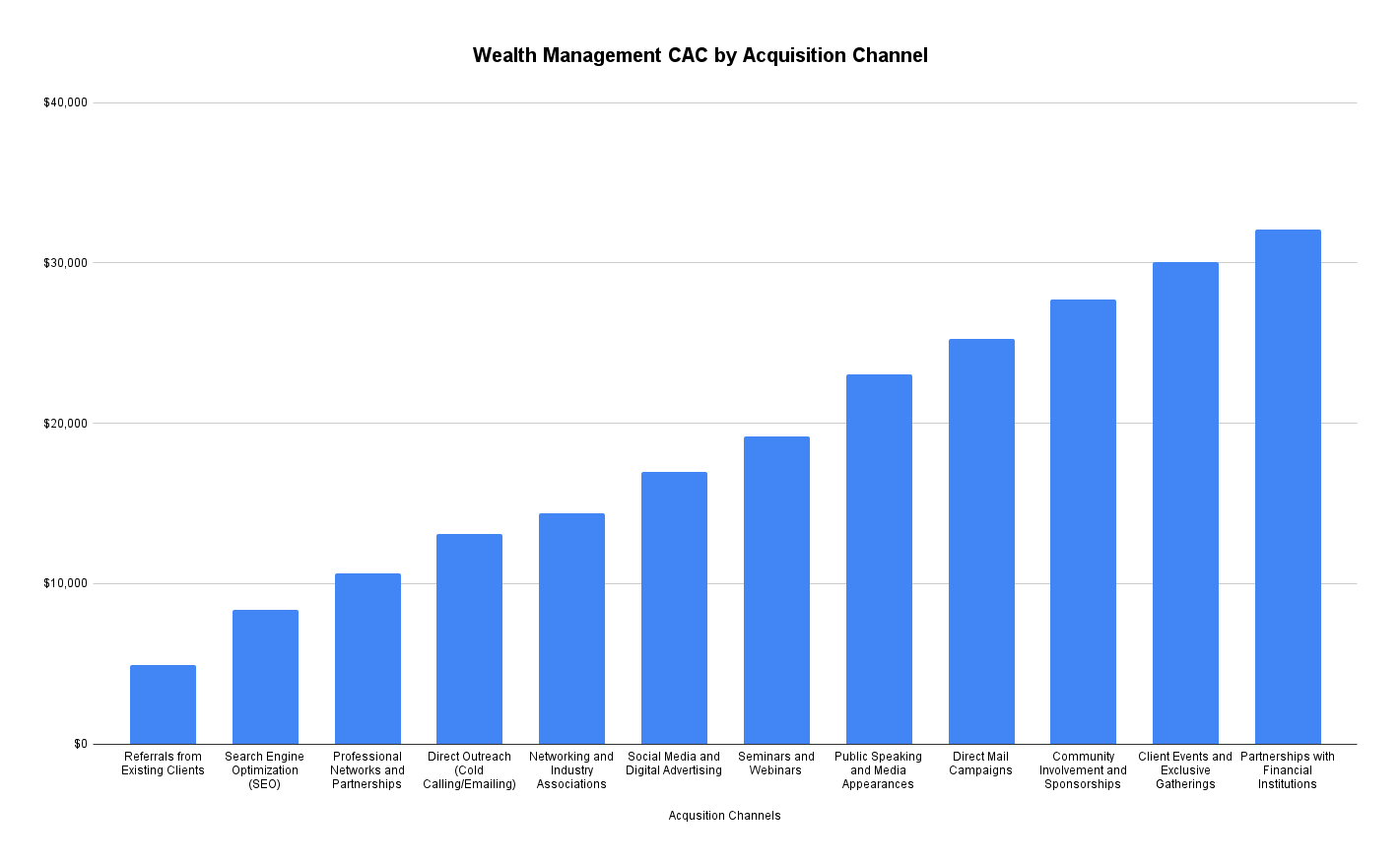

Average Customer Acquisition Cost by Acquisition Channel

This table gives the average CAC by the acquisition channel used.

| Acqusition Channels | CAC |

|---|---|

| Referrals from Existing Clients | $4,932 |

| Search Engine Optimization (SEO) | $8,361 |

| Professional Networks and Partnerships | $10,618 |

| Direct Outreach (Cold Calling/Emailing) | $13,095 |

| Networking and Industry Associations | $14,406 |

| Social Media and Digital Advertising | $16,954 |

| Seminars and Webinars | $19,188 |

| Public Speaking and Media Appearances | $23,045 |

| Direct Mail Campaigns | $25,248 |

| Community Involvement and Sponsorships | $27,741 |

| Client Events and Exclusive Gatherings | $30,070 |

| Partnerships with Financial Institutions | $32,080 |

Average Customer Acquisition Cost by Size of Wealth Management Firm

Our data concluded that the size of the wealth management firm has a significant impact on the CAC.

| Size of Firm | AUM | Organic CAC | Paid CAC |

|---|---|---|---|

| Small | Up to $100 million | $32,551 | $48,873 |

| Boutique | $100 million - $500 million | $28,774 | $43,202 |

| Mid-Sized | $500 million - $2 billion | $22,949 | $34,457 |

| Large | $2 billion - $10 billion | $18,609 | $27,940 |

| Very Large | $10 billion - $50 billion | $12,552 | $18,846 |

| Mega | $50 billion and above | $7,187 | $10,791 |

Average Customer Acquisition Cost by Wealth Management Service

Each service offered in the scope of wealth management will have a slightly different CAC.

| Wealth Management Services | Organic CAC | Paid CAC |

|---|---|---|

| Basic Financial Planning | $3,876 | $5,819 |

| Investment Management | $5,549 | $8,331 |

| Retirement Planning | $7,292 | $10,948 |

| Tax Planning and Optimization | $9,702 | $14,568 |

| Estate Planning | $10,740 | $16,126 |

| Insurance and Risk Management | $12,897 | $19,365 |

| Education Planning | $14,777 | $22,186 |

| Debt Management and Reduction | $16,094 | $24,164 |

| Philanthropic Planning | $19,193 | $28,817 |

| Business Succession Planning | $20,200 | $30,328 |

| Trust Services | $21,758 | $32,669 |

| Family Office Services | $24,657 | $37,021 |

| Alternative Investments (Private Equity, Hedge Funds) | $25,264 | $37,933 |

| Real Estate Investment Management | $28,678 | $43,059 |

| Global Wealth Management | $29,242 | $43,904 |

| Custom/Bespoke Investment Strategies | $30,843 | $46,308 |

Next Steps & Downloading a Copy of this Report

If you have any further questions or wish to download a copy of this report, feel free to contact us on our Contact Us page. If you are a wealth manager looking to lower your customer acquisition cost, feel free to contact us to speak about a thought leadership SEO campaign.

Sources: