Our team recently analyzed the average customer lifetime value (CLV) for financial services, further broken down by service, customer income level, and organization size. To calculate customer lifetime value, we used the following formulas.

Customer Lifetime Value Formula for Financial Services

At the core of the formula, we are attempting to calculate the customer value per year or month, multiplied by the average customer lifespan. However, for varying financial services, this formula can become more complex. For services such as consumer lending, the formula is based on the average number of loans, the average loan amount, etc.

- Revenue – Includes all types of income generated from the customer, such as:

-

-

- Interest from loans, mortgages, and credit cards.

- Fees from account maintenance, transaction charges, and investment management.

- Commission or brokerage fees from trading and investments.

-

- Profit Margin – This represents the percentage of the revenue that translates into profit after deducting costs such as interest expenses, service costs, and risk provisions.

- Discount Rate – The discount rate, which reflects the time value of money (how much future revenue is worth today).

- Customer Acquisition Cost (CAC) – The cost of acquiring a new customer.

For recurring revenue models such as banks or insurance, we use the following formula.

- Average Revenue per Customer – The average income earned per customer over a specified period.

- Gross Margin – The profit margin percentage after accounting for costs.

- Churn Rate – The percentage of customers who leave or close their accounts within a specific period.

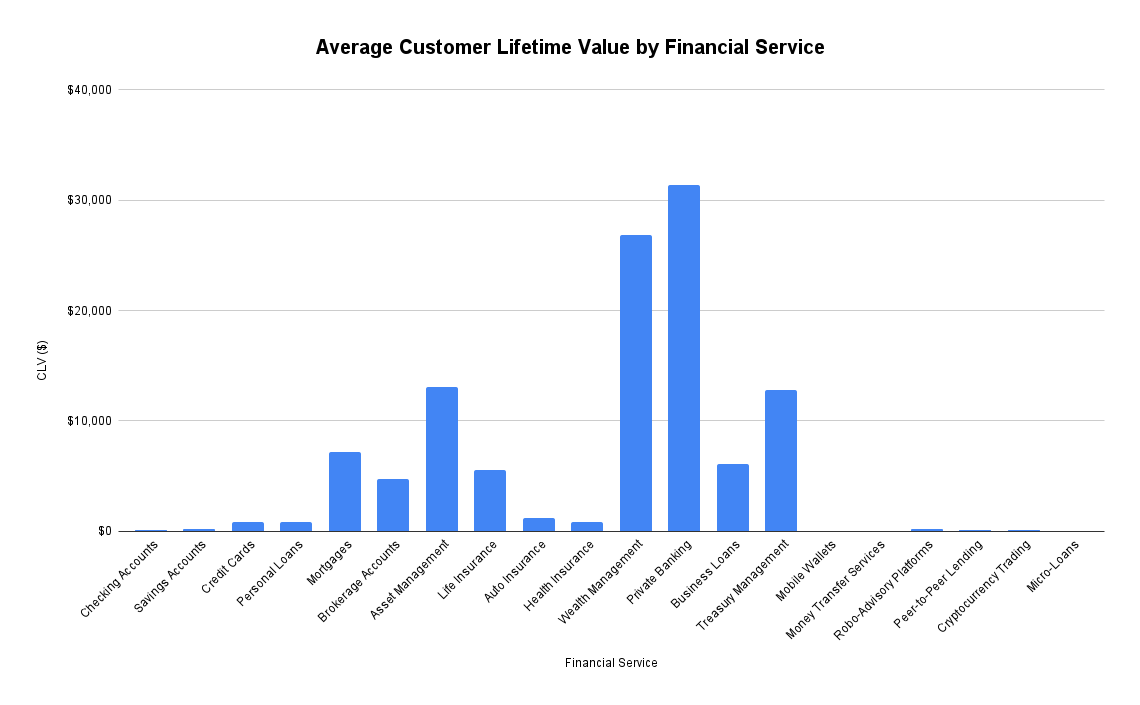

Average Customer Lifetime Value in Financial Services by Service

The following table shows the average customer lifetime value in financial services broken down by the service.

| Financial Service | CLV ($) |

|---|---|

| Checking Accounts | $106 |

| Savings Accounts | $181 |

| Credit Cards | $808 |

| Personal Loans | $829 |

| Mortgages | $7,204 |

| Brokerage Accounts | $4,783 |

| Asset Management | $13,062 |

| Life Insurance | $5,591 |

| Auto Insurance | $1,194 |

| Health Insurance | $848 |

| Wealth Management | $26,820 |

| Private Banking | $31,392 |

| Business Loans | $6,088 |

| Treasury Management | $12,791 |

| Mobile Wallets | $12 |

| Money Transfer Services | $17 |

| Robo-Advisory Platforms | $251 |

| Peer-to-Peer Lending | $125 |

| Cryptocurrency Trading | $151 |

| Micro-Loans | $18 |

Average Customer Lifetime Value in Financial Services by Income Level

This table segments our data based on income level.

| Income Level | Income Range ($) | CLV ($) | Customer Lifespan (Years) |

|---|---|---|---|

| Very Low Income | < $20,000 | $112 | 3 |

| Low Income | $20,001 – $40,000 | $501 | 5 |

| Lower Middle Income | $40,001 – $60,000 | $1,004 | 6 |

| Middle Income | $60,001 – $80,000 | $2,133 | 7 |

| Upper Middle Income | $80,001 – $100,000 | $4,666 | 8 |

| High Income | $100,001 – $150,000 | $8,823 | 10 |

| Very High Income | $150,001 – $250,000 | $18,792 | 12 |

| Ultra High Income | > $250,000 | $38,900 | 15 |

Average Customer Lifetime Value in Financial Services by Organization Size

In the following dataset, we segmented the information based on the organization size.

| Organization Size | Employees | Annual Revenue ($) | CLV ($) | Customer Lifespan (Years) |

|---|---|---|---|---|

| Micro Businesses | < 10 | < $1 million | $1,503 | 5 |

| Small Businesses | 10 – 49 | $1M – $10M | $7,508 | 7 |

| Medium Businesses | 50 – 249 | $10M – $50M | $37,846 | 10 |

| Large Businesses | 250 – 999 | $50M – $500M | $156,966 | 12 |

| Enterprise Businesses | ≥ 1,000 | > $500 million | $703,468 | 15 |

Next Steps: Raising Your LTV

The primary lever to raise your LTV in the short term without changing products or pricing structure is to lower your customer acquisition cost. Lowering the CAC directly increases the CLV figure as seen in the formulas above.

The best way to lower your CAC is to shift to an organic-based marketing strategy. While organic takes more time and strategic development than paid advertising channels, once developed, organic channels will become a lead generation system, continually rising in ROI as they are invested in.

If you are interested in developing an organic sales approach for your company, feel free to watch our training here.